TechCrunch

TechCrunch

Despite promises to examine and reform hiring practices so that tech companies big and small better reflect the world we all live in, diversity reports chart a different path: Black, brown, female and LGBTQIA+ folks aren’t getting their representative seats at the table.

And now, in the wake of a national response to the killings of George Floyd, Breonna Taylor and Tony McDade by police that has seen millions engage in protests and a seemingly sudden awareness of just how racist the world is, the tech industry has found itself dealing with a crisis of conscience.

Leadership in companies everywhere have held meetings — sometimes putting folks of color in the hot seat — to discuss ways to improve awareness around race and devise plans to implement those initiatives (disclosure: I attended one hosted by TechCrunch’s parent company Verizon). HR departments are checking in with staff to somehow ascertain how to improve their modes of operation.

It is in this climate that TechCrunch is reporting our 2019 events and staff diversity numbers – the fourth such report since we started tracking – which you can see below. To collect this data, we distributed anonymous, volunteer surveys to the panelists, judges and Battlefield competitors at all of our events. We also distributed a form to staff, which was also volunteer and anonymous.

TechCrunch Events

In 2019, we produced six events in three countries in 2019: Disrupt in San Francisco and Berlin; Sessions Robotics, Mobility and Enterprise were held in the Bay Area; and a regional Battlefield in Shenzhen.

Our events draw folks from every corner of the startup world. Whether a founder, an investor onstage or an attendee interested in technology, our events have long served as a place where people could come together to get advice, network, watch the best startups compete on our Battlefield stage and hear from the biggest names in tech.

Our priority at our events is to amplify the voices that have been silenced by the majority. While we continue to see an increase in the number of people of color and white women at our events, we acknowledge that we are still not where we want to be.

Below are the demographic data on panelists, judges and Battlefield competitors from our 2019 events.

Disrupt

For almost 10 years, TechCrunch Disrupt has provided a space for startup founders and investors to exchange ideas, make connections, examine the tech industry and compete on the Battlefield stage. Hundreds of startups across a variety of categories tell their stories to the 10,000 attendees from all around the world.

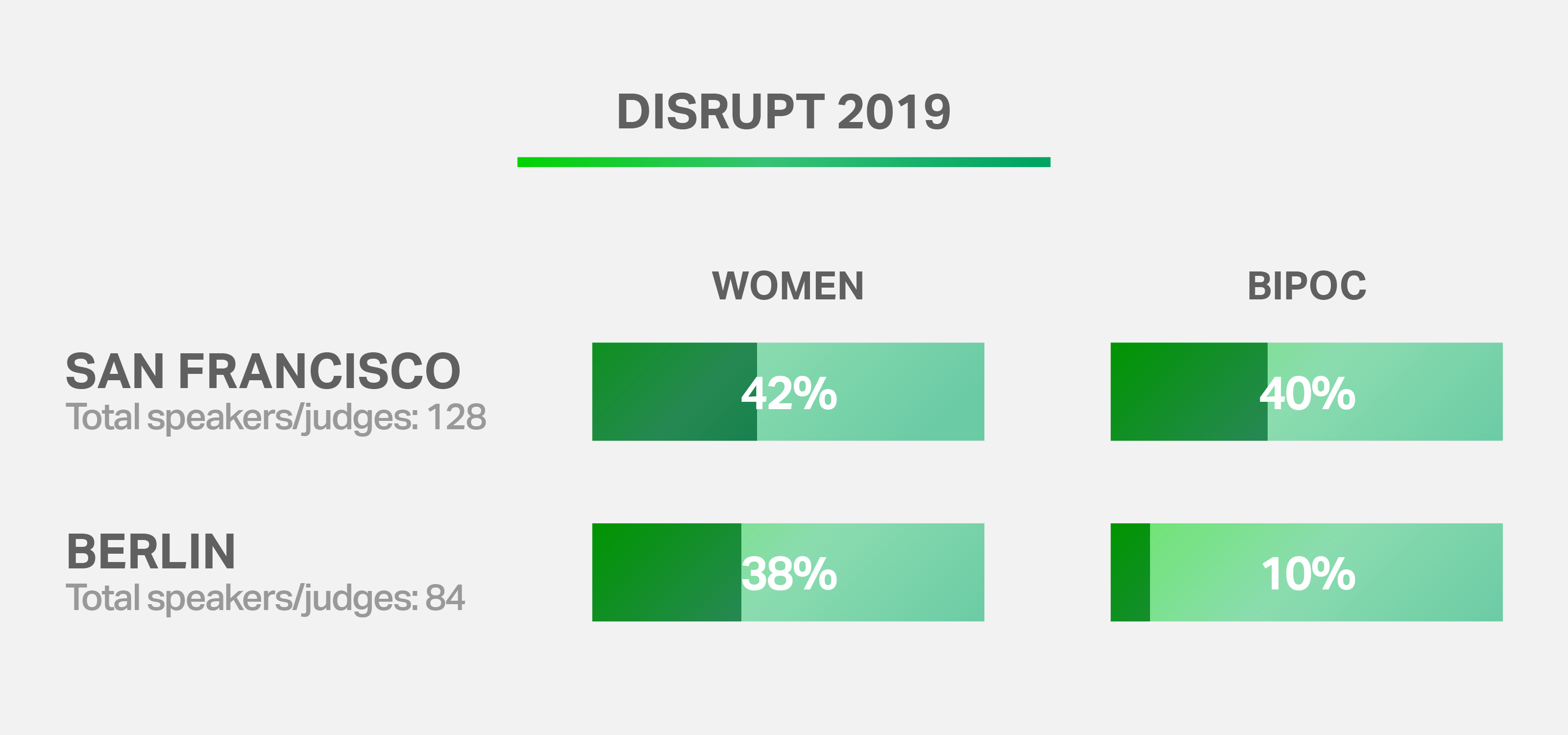

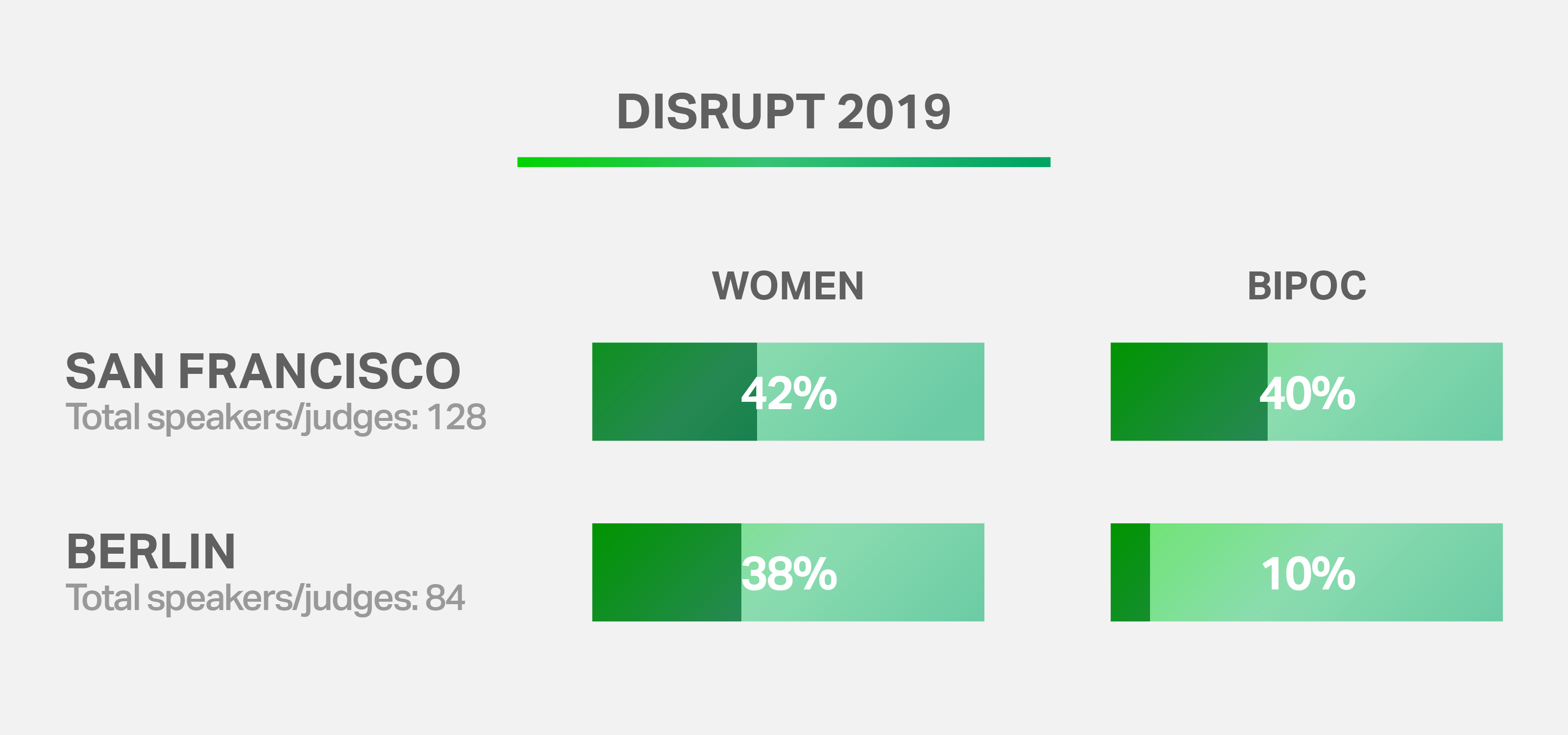

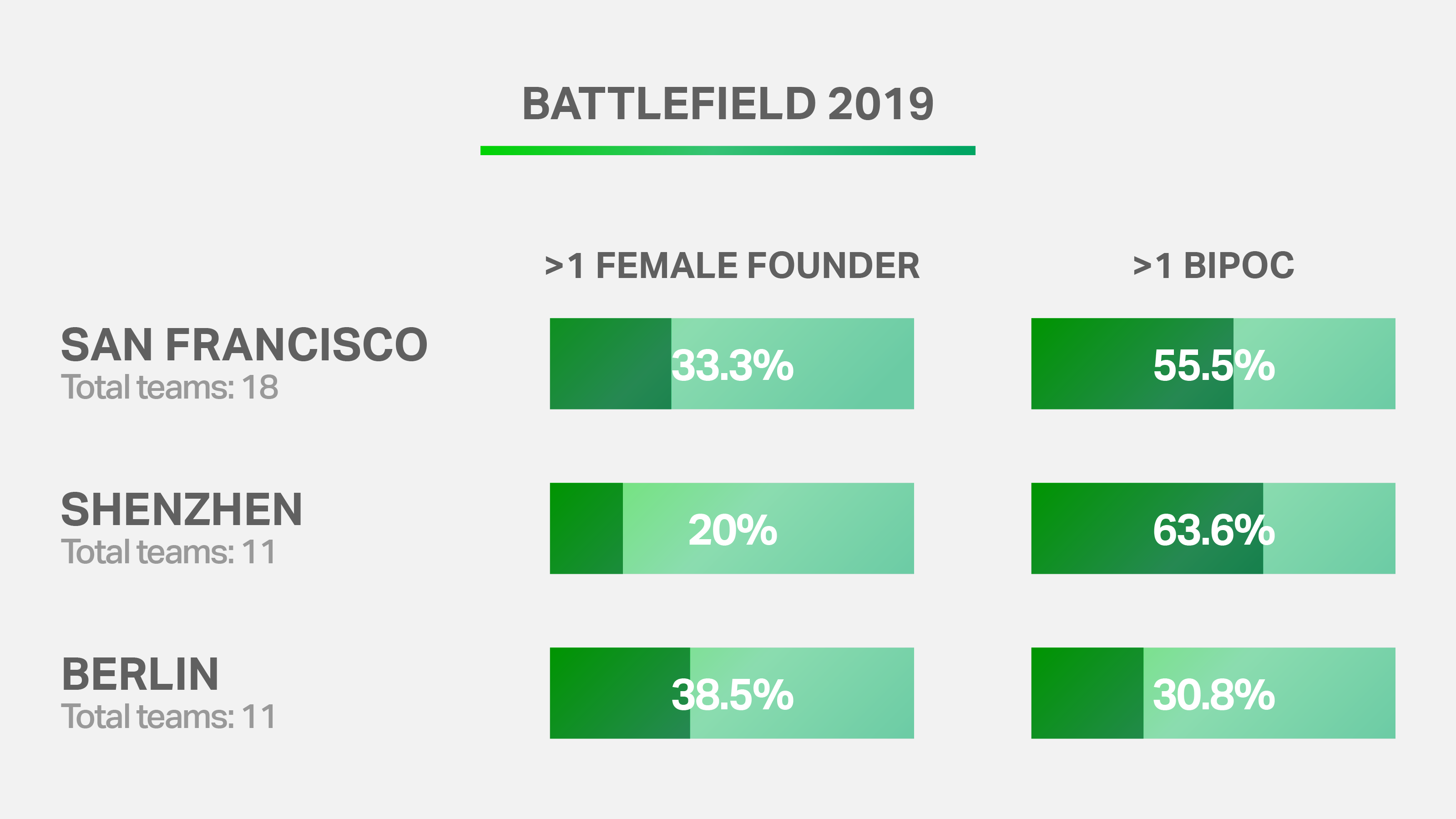

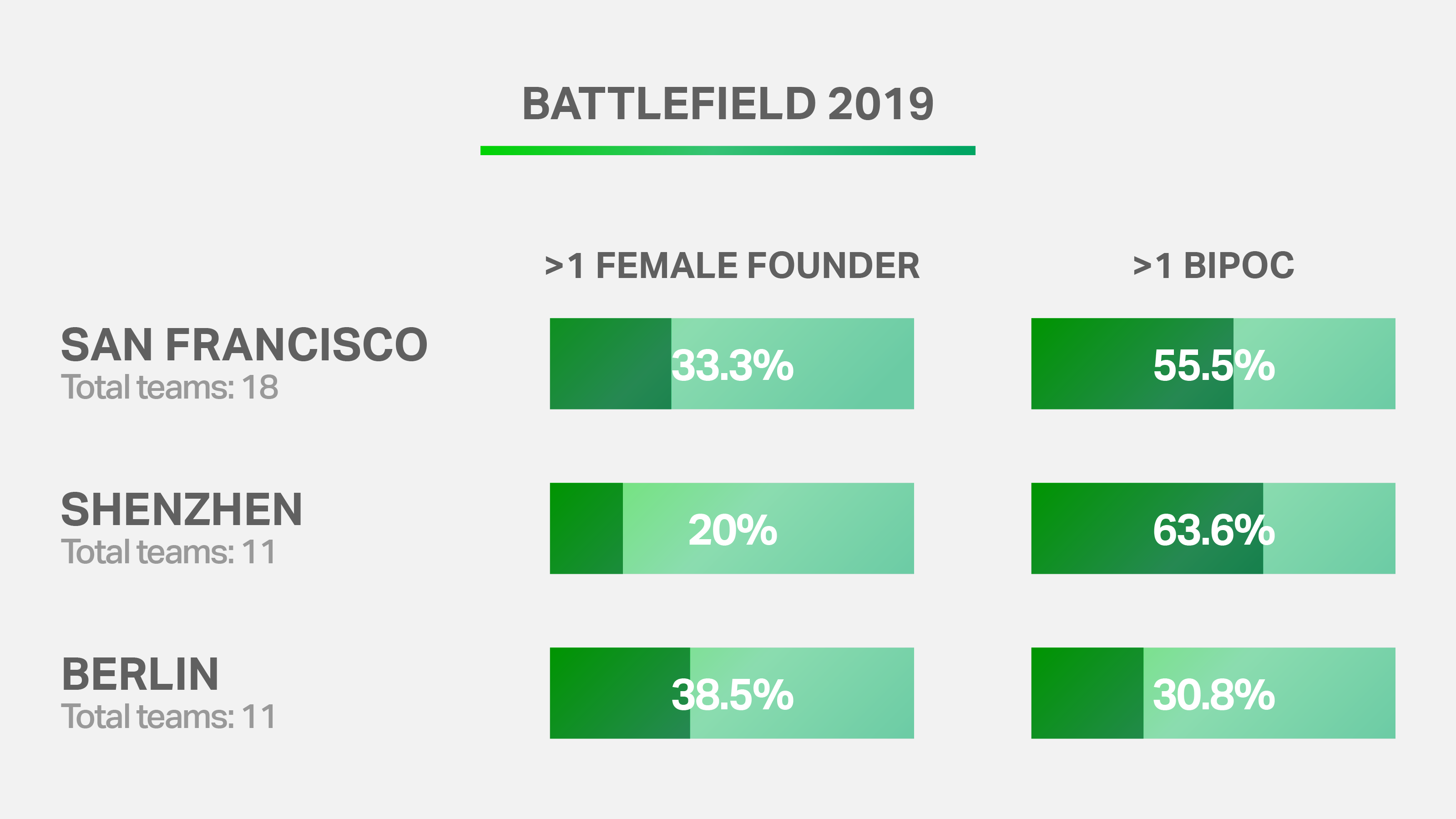

For the first time, in 2019, we hosted Disrupt SF at a bigger venue, Moscone West. Of the 128 speakers and Startup Battlefield judges who self-reported, 54 identified as women (42%) and 52 identified as people of color (40%). On the Battlefield stage at Disrupt SF, 18 companies competed for the Disrupt Cup. There were six self-identified female founders (33%) and 10 (56%) founders who self-identified as a person of color.

At Disrupt Berlin, of the 84 speakers and Startup Battlefield judges who self-reported, 32 (38%) identified as women and nine (10%) identified as people of color. Of the 13 companies that competed in Startup Battlefield, four (31%) founders identified as a person of color and five founders (38%) identified as female.

In 2019, we hosted our Hardware Battlefield competition in Shenzhen, which saw 11 companies take the stage and pitch to a panel of judges. Three (27%) of the 11 founders identified as female and seven (64%) identified as a person of color.

To complement the pitch competition and highlight the issues faced by those in the Chinese ecosystem, we invited top speakers from the startup world in China and beyond to grace our stage. Of the 39 speakers and judges who self-reported, four (10%) identified as women and 26 (66%) identified as a person of color.

Sessions

Our Sessions events are daylong programs dedicated to the popular topics that bring founders, engineers, investors and academics to one place.

TechCrunch Sessions: Robotics continues to be a popular event no matter where we host it. In 2019, Robotics returned to Zellerbach Hall on the campus of UC Berkeley. Of the 32 speakers who self-reported, eight (25%) identified as female and 11 (34%) identified as a person of color.

In 2019, we launched TechCrunch Sessions: Mobility in San Jose. Of the 38 speakers who self-reported, 10 (26%) identified as female and 8 (21%) identified as a person of color.

We also launched TechCrunch Sessions: Enterprise in 2019. Of the 40 speakers who self-reported, 12 (30%) identified as female and 12 (30%) identified as a person of color.

TechCrunch Include 3.0

TechCrunch Include aims to promote diversity by applying resources uniquely available to TechCrunch, including our editorial and events platforms, and by exemplifying the diversity mission in TechCrunch’s own staffing and culture.

In 2014, we launched the Include program as a donation vehicle. It evolved from that into version 2.0, during which we realized the fulfillment of our plan to be transparent and remain proactive about our diversity and inclusion efforts at our events, on our staff, and in our editorial.

Now, Include 3.0, which launches at Disrupt 2020, we will continue to pursue a collaborative and open relationship with the broader community through partnerships with founder and support organizations, and investor groups. Founder organizations will have the opportunity to nominate early-stage founders to participate in the program as well as serve as advisers to TechCrunch Include. Investor groups commit to establishing lasting relationships with founders in the program and to uphold accountability for representation within their organizations and their investment portfolios. And support organizations provide educational resources and mentorships to strengthen and advise the program including all who participate.

TechCrunch Staff

Everyone should have access to the immense possibilities that the tech industry provides, but for the actual numbers to reflect this requires actively addressing the very unconscious biases that have contributed to rampant inequality.

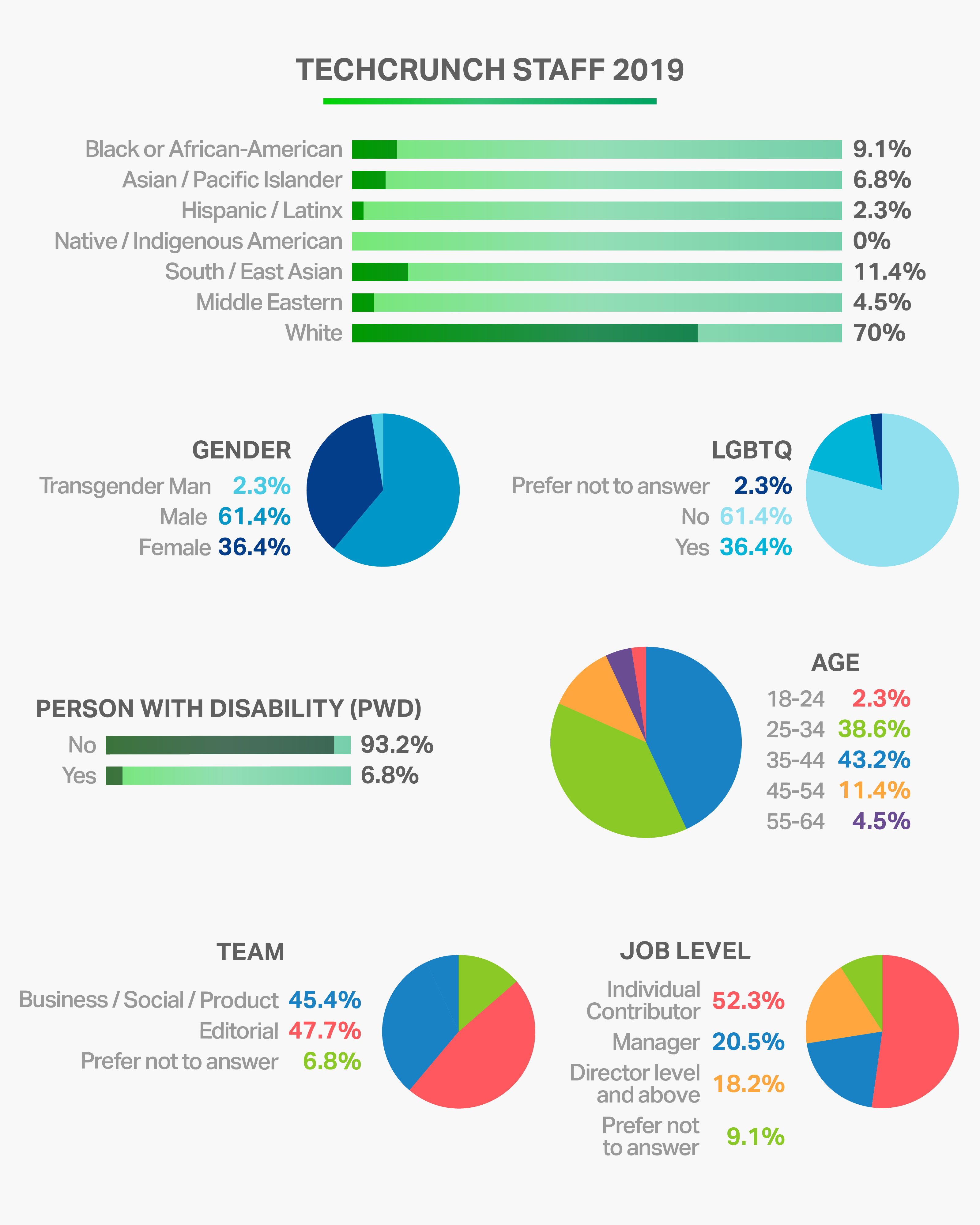

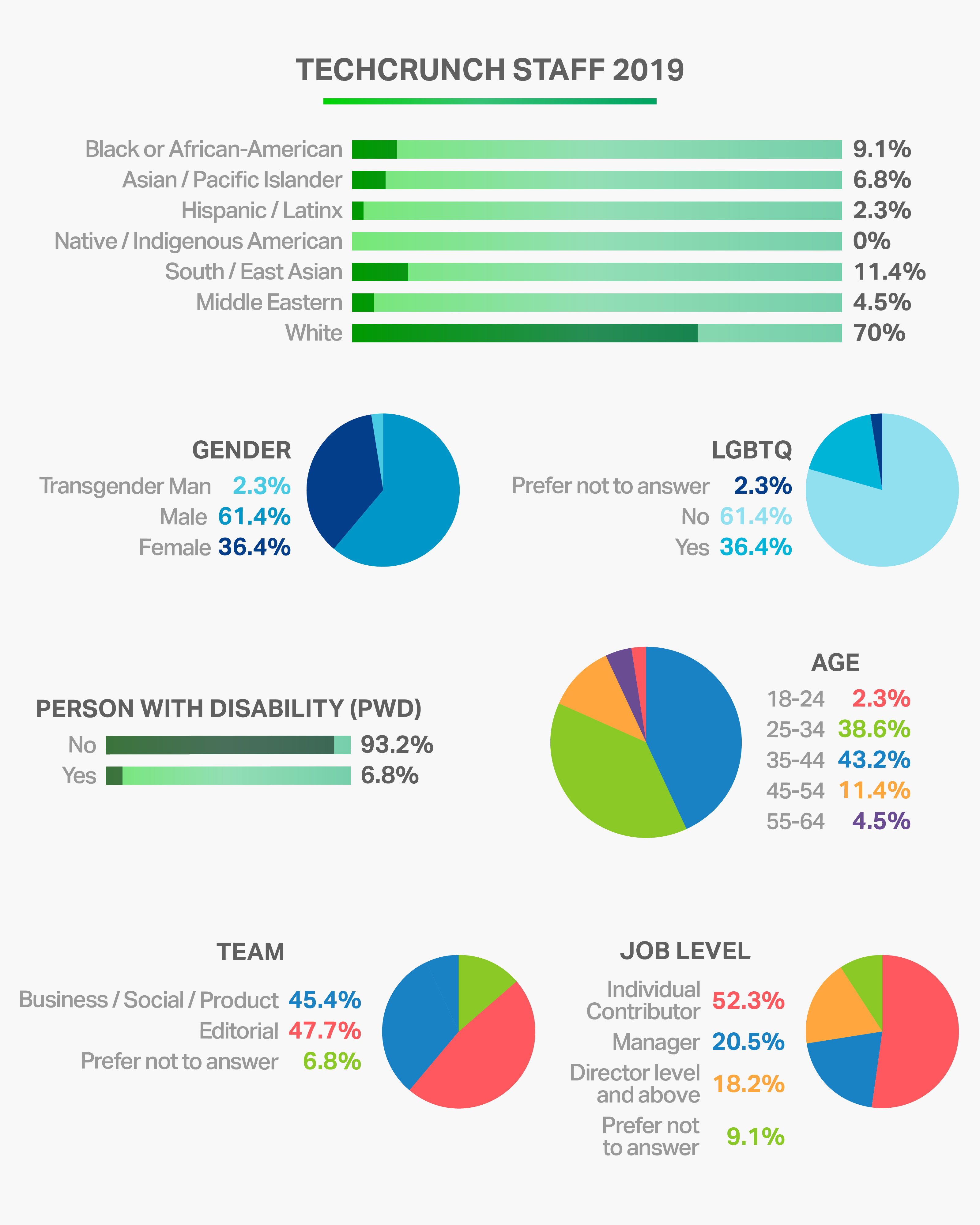

At TechCrunch, our own diversity does not yet reflect this. In 2019, we surveyed our staff, and the results tell us that we have fallen well short of the goal we set. Of 71 editorial, events, business and sales staff, 44 completed the voluntary survey: 70% of the respondents identified as white, 36% identified as women, and 18% identified as LGBTQ+.

We understand that diversity is vital to the pursuit of equality, and while we can look at the last few years and see slight improvement, it is just that: slight. We need to focus our efforts so that our stages and our staff represent more accurately the world in which we live. We are not there yet.

Already in 2020 we have produced two events: Sessions: Robotics in at UC Berkeley — just before California Gov. Gavin Newsom ordered the state to shelter-in-place — and Early Stage, which we produced virtually. We are on track to improve our diversity numbers not only in events but also on staff and we will report them in January 2021.

As Black Lives Matter protests in response to police brutality continue amid a worsening global pandemic, TechCrunch will continue to produce events that showcase the diverse talent in the startup community.

And at the foundation will be a small but mighty team focused on the present so we can bring you the future.

]]>

TechCrunch

TechCrunch

Unity Software Inc. is set to list on the New York Stock Exchange this month, following its S-1 filing two weeks ago. The 16-year-old tech company is universally known within the gaming industry and largely unknown outside of it. But Unity has been expanding beyond gaming, pouring hundreds of millions of dollars into a massive bet to be an underlying platform for humanity’s future in a world where interactive 3D media stretches from our entertainment experiences and consumer applications to office and manufacturing workflows.

Much of the press about Unity’s S-1 filing mischaracterizes the business. Unity is easily misunderstood because most people who aren’t (game) developers don’t know what a game engine actually does, because Unity has numerous revenue streams, and because Unity and the competitor it is most compared to — Epic Games — only partially overlap in their businesses.

Last year, I wrote an in-depth guide to Unity’s founding and rise in popularity, interviewing more than 20 top executives in San Francisco and Copenhagen, plus many other professionals in the industry. In this two-part guide to get up to speed on the company, I’ll explain Unity’s business, where it is positioned in the market, what its R&D is focused on and how game engines are eating the world as they gain adoption across other industries.

In part two, I’ll analyze Unity’s financials, explain how the company has positioned itself in the S-1 to earn a higher valuation and outline both the bear and bull cases for its future.

For those in the gaming industry who are familiar with Unity, the S-1 might surprise you in a few regards. The Asset Store is a much smaller business that you might think, Unity is more of an enterprise software company than a self-service platform for indie devs and advertising solutions appear to make up the largest segment of Unity’s revenue.

What is a game engine?

Unity’s origin is as a game engine, software that is similar to Adobe Photoshop, but used instead for editing games and creating interactive 3D content. Users import digital assets (often from Autodesk’s Maya) and add logic to guide each asset’s behavior, character interactions, physics, lighting and countless other factors that create fully interactive games. Creators then export the final product to one or more of the 20 platforms Unity supports, such as Apple iOS and Google Android, Xbox and Playstation, Oculus Quest and Microsoft HoloLens, etc.

In this regard, Unity is more comparable to Adobe and Autodesk than to game studios or publishers like Electronic Arts and Zynga.

What are Unity’s lines of business?

Since John Riccitiello took over as CEO from co-founder David Helgason in 2014, Unity has expanded beyond its game engine and has organized activities into two divisions: Create Solutions (i.e., tools for content creation) and Operate Solutions (i.e., tools for managing and monetizing content). There are seven noteworthy revenue streams overall:

Create Solutions (29% of H1 2020 revenue)

- The Unity platform: The core game engine, which operates on a freemium subscription model. Individuals, small teams and students use it for free, whereas more established game studios and enterprises in other industries pay (via the Unity Plus, Unity Pro and Unity Enterprise premium tiers).

- Engine extensions: A growing portfolio of tools and extensions of the core engine purpose-built for specific industries and use cases. These include MARS for VR development, Reflect for architecture and construction use with BIM assets, Pixyz for importing CAD data, Cinemachine for virtual production of films and ArtEngine for automated art creation.

- Professional services: Hands-on, specialized consulting for enterprise customers using Unity’s engine and other products. Unity expanded its consulting capacity further in April with a $55 million acquisition of Finger Food Studios, a 200-person team in Vancouver that builds interactive media projects for corporate clients using Unity.

Aside from these three product categories, Unity is reporting another group of content creation offerings separately in the S-1 as “Strategic Partnerships & Other” (which accounts for further 9% of revenue):

- Strategic Partnerships: Major tech companies pay Unity via a mix of structures (flat-fee, revenue-share and royalties) for Unity to create and maintain integrations with their software and/or hardware. Since Unity is the most popular platform to build games with, ensuring Unity integrates well with Oculus or with the Play Store is very important to Facebook and Google, respectively, for example.

- Unity Asset Store: Unity’s marketplace for artists and developers to buy and sell digital assets like a spooky forest or the physics to guide characters’ joint movements for use in their content so they don’t each have to design and code1 every single thing from scratch. It is commonly used, though larger game studios often use Asset Store assets just for initial prototyping of game ideas.

Operate Solutions (62% of H1 2020 revenue)

- Advertising: Via the 2014 acquisition of Applifier, Unity launched an in-game advertising network for mobile games. This expanded substantially with the Unified Auction, a simultaneous auction that helps games get the highest bid from among potential advertisers. Unity is now one of the world’s largest mobile ad networks, serving 23 billion ads per month. Unity also has a dynamic monetization tool that makes real-time assessments of whether it is optimal to serve an ad, prompt an in-app purchase or do nothing to maximize each player’s lifetime value. While the Unity IAP feature enables developers to manage in-app purchases (IAP), Unity does not take a cut of IAP revenue at this time.

- Live Services: A portfolio of cloud-based solutions for game developers to better manage and optimize their user acquisition, player matchmaking, server hosting and identification of bugs. This portfolio has primarily been assembled through acquisitions like Multiplay (cloud game server hosting and matchmaking), Vivox (cloud-hosted system for voice and text chat between players in games), and deltaDNA (player segmentation for campaigns to improve engagement, monetization and retention). There is also Unity Simulate for training AI models in virtual recreations of the real world (or testing games for bugs). Live Services products have usage-based pricing, with an initial amount of usage free.

Unity versus Unreal, versus others

Unity is compared most frequently to Epic Games, the company behind the other leading game engine, Unreal. Below is a quick overview of the products and services that differentiate each company. The cost of switching game engines is meaningful in that developers are typically specialized in one or the other and can take months to gain high proficiency in another, but some teams do vary the engine they use for different projects. Moving an existing game (or other project) over to a new game engine is a major undertaking that requires extensive rebuilding.

Epic Games

Epic has three main businesses: game development, the Epic Games Store, and the Unreal Engine. Epic’s core is in developing its own games and the vast majority of Epic’s $4.2 billion in 2019 revenue came from that (principally, from Fortnite). The Epic Games Store is a consumer-facing marketplace for gamers to purchase and download games; game developers pay Epic a 12.5% cut of their sales.

In those two areas of business, Unity and Epic don’t compete. While much of the press about Unity’s IPO frames Epic’s current conflict with Apple as an opportunity for Unity, it is largely irrelevant. A court order prevented Apple from blocking iOS apps made with Unreal in retaliation for Epic trying to skirt Apple’s 30% cut of in-app purchases in Fortnite. Unity doesn’t have any of its own apps in the App Store and doesn’t have a consumer-facing store for games. It’s already the default choice of game engine for anyone building a game for iOS or Android, and it’s not feasible to switch the engine of an existing game, so Epic’s conflict does not create much of a new market opening.

Let’s compare the Unity and Unreal engines:

Origins: Unreal was Epic’s proprietary engine for the 1998 game Unreal and was licensed to other PC and console studios and became its own business as a result of its popularity. Unity launched as an engine for indie developers building Mac games, an underserved niche, and expanded to other emerging market segments considered irrelevant by the core gaming industry: small indie studios, mobile developers, AR & VR games. Unity exploded in global popularity as the main engine for mobile games.

Programming Language: Based in the C++ programming language, Unreal requires more extensive programming than Unity (which requires programming in C#) but enables more customization, which in turn enables higher performance.

Core Markets: Unreal is much more popular among PC and console game developers; it is oriented toward bigger, high-performance projects by professionals. That said, it is establishing itself firmly in AR and VR and proved with Fortnite it can take a console and PC game cross-platform to mobile. Unity dominates in mobile games — now the largest (and fastest growing) segment of the gaming industry — where it has over 50% market share and where Unreal is not a common alternative. Unity has kept the largest market share in AR and VR content, at over 60%.

Ease of Authoring: Neither engine is easy for a complete novice, but both are fairly straightforward to navigate if you have basic coding abilities and put the time into experimenting and watching tutorials. Unity has prioritized ease of use since its early days, with a mission of democratizing game development that was so concentrated among large studios with large budgets, and ease of authoring remains a key R&D focus. This is why Unity is the common choice in educational environments and by individuals and small teams creating casual mobile games. Unity lets you see but not edit the engine’s source code unless you pay for an enterprise subscription; this protects developers from catastrophic mistakes but limits customization. Unreal isn’t dramatically more complex but, as a generalization, it requires more lines of code and technical skill. It is open source code so can be completely customized. Unreal has a visual scripting tool called Blueprint to conduct some development without needing to code; it’s respected and often used by designers though not a no-code solution to developing a complex, high-performance game (no one offers that). Unity recently rolled out its own visual scripting solution for free called Bolt.

Pricing: While Unity’s engine operates on a freemium subscription model (then has a portfolio of other product offerings), Unreal operates on a revenue-share, taking 5% of a game’s revenue. Both have separately negotiated pricing for companies outside of gaming that aren’t publicly disclosed.

Proprietary engines

Many large gaming companies, especially in the PC and console categories, continue to use their own proprietary game engines built in-house. It is a large, ongoing investment to maintain a proprietary engine, which is why a growing number of these companies are switching to Unreal or Unity so they can focus more resources on content creation and tap into the large talent pools that already have mastery in each one.

Other Engines

Other game engines to note are Cocos2D (an open source framework by Chukong Technologies that has a particular following among mobile developers in China, Japan, and South Korea), CryEngine by Crytek (popular for first-person shooters with high visual fidelity), and Amazon’s Lumberyard (which was built off CryEngine and doesn’t seem to have widespread adoption, or command much respect, among the many developers and executives I’ve spoken to).

For amateur game developers without programming skills, YoYo Games’ GameMaker Studio and Scirra’s Construct are both commonly used to build simple 2D games (Construct is used for HTML5 games in particular); users typically move on to Unity or Unreal as they gain more skill.

There remain a long list of niche game engines in the market since every studio needs to use one and those who build their own often license it if their games aren’t commercial successes or they see an underserved niche among studios creating similar games. That said, it’s become very tough to compete with the robust offerings of the industry standards — Unity and Unreal — and tough to recruit developers to work with a niche engine.

UGC Platforms

User-generated content platforms for creating and playing games like Roblox (or new entrants like Manticore’s Core and Facebook Horizon) don’t compete with Unity — at least for the foreseeable future — because they are dramatically simplified platforms for creating games within a closed ecosystem with dramatically more limited monetization opportunity. The only game developers these will pull away from Unity are hobbyists on Unity’s free tier.

I’ve written extensively on how UGC-based game platforms are central to the next paradigm of social media, anchored within gaming-centric virtual worlds. But based on the overall gaming market growth and the diversity of game types, these platforms can continue to soar in popularity without being a competitive threat to the traditional studios who pay Unity for its engine, ad network, or cloud products.

What’s at the forefront of Unity’s technical innovation?

DOTS

For the last three years, Unity has been creating its “data oriented technology stack,” or DOTS, and gradually rolling it out in modules across the engine.

Unity’s engine centers on programming in C# code which is easier to learn and more time-saving than C++ since it is a slightly higher level programming language. Simplification comes with the trade off of less ability to customize instruction by directly interacting with memory. C++, which is the standard for Unreal, enables that level of customization to achieve better performance but requires writing a lot more code and having more technical skill.

DOTS is an effort to not just resolve that discrepancy but achieve dramatically faster performance. Many of the most popular programming languages in use today are “object-oriented,” a paradigm that groups characteristics of an object together so, for example, an object of the type “human” has weight and height attached. This is easier for the way humans think and solve problems. Unity takes advantage of the ability to add annotations to C# code and claims a proprietary breakthrough in understanding how to recompile object-oriented code into “data-oriented” code, which is optimized for how computers work (in this example, say all heights together and all weights together). This is orders of magnitude faster in processing the request at the lowest level languages that provide 1s-and-0s instructions to the processor.

This level of efficiency should, on one hand, allow highly-complex games and simulations with cutting-edge graphics to run quickly on GPU-enabled devices, while, on the other hand, allowing simpler games to be so small in file size they can run within messenger apps on the lowest quality smartphones and even on the screens of smart fridges.

Unity is bringing DOTS to different components of its engine one step at a time and users can opt whether or not to use DOTS for each component of their project. The company’s Megacity demo (below) shows DOTS enabling a sci-fi city with hundreds of thousands of assets rendered in real-time, from the blades spinning on the air conditioners in every apartment building to flying car traffic responding to the player’s movements.

Graphics

The forefront of graphics technology is in enabling ray tracing (a lighting effect mimicking the real-life behavior of light reflecting off different surfaces) at a fast enough rendering speed so games and other interactive content can be photorealistic (i.e. you can’t tell it’s not the real world). It’s already possible to achieve this in certain contexts but takes substantial processing power to render. Its initial use is for content that is not rendered in real-time, like films. Here are videos by both Unity and Unreal demonstrating ray tracing used to make a digital version of a BMW look nearly identical to video of a real car:

To support ray-tracing and other cutting-edge graphics, Unity released its High Definition Render Pipeline in 2018. It gives developers more powerful graphics rendering for GPU devices to achieve high visual fidelity in console and PC games plus non-gaming uses like industrial simulations. (By comparison, its Universal Render Pipeline optimizes content for lower-end hardware like mobile phones.)

Next-gen authoring

Unity’s Research Labs team is focused on the next generation of authoring tools, particularly in an era of AR or VR headsets being widely adopted. One component of this is the vision for a future where nontechnical people could develop 3D content with Unity solely through hand gestures and voice commands. In 2016, Unity released an early concept video for this project (something I demo-ed at Unity headquarters in SF last year):

Game engines are eating the world

The term “game engine” limits the scope of what Unity and Unreal are already used for. They are interactive 3D engines used for practically any type of digital content you can imagine. The core engine is used for virtual production of films to autonomous vehicle training simulations to car configurators on auto websites to interactive renderings of buildings.

Both of these engines have long been used outside gaming by people repurposing them and over the last five years Unity and Unreal have made expanding use of their engines in other industries a top priority. They are primarily focused on large- and mid-size companies in 1) architecture, engineering, and construction, 2) automotive and heavy manufacturing, and 3) cinematic video.

In films and TV commercials, game engines are used for virtual production. The settings, whether animated or scanned from real-world environments, are set up as virtual environments (like those of a video game) where virtual characters interact and the camera view can be changed instantaneously. Human actors are captured through sets that are surrounded by the virtual environment on screens. The director and VFX team can change the surroundings, the time of day, etc. in real-time to find the perfect shot.

There are a vast scope of commercial uses for Unity since assets can be imported from CAD, BIM, and other formats and since Unity gives you the ability to build a whole world and simulate changes in real-time. There are four main use cases for Unity’s engine beyond entertainment experiences:

- Design & Planning: have teams work on interactive 3D models of their product simultaneously (in VR, AR, or on screens) from offices around the world and attach metadata to every component about its materials, pricing, etc. The Hong Kong International airport used Unity to create a digital twin of the terminals connected to Internet of Things (IoT) data, informing them of passenger flow, maintenance issues, and more in real-time.

- Training, Sales & Marketing: use interactive 3D content so staff or customers can engage with: a) photorealistic renderings of industrial products; b) VR trainings for risky construction situations; c) online car configurators that render custom designs in real-time; or d) an architect’s plan for new office space with every asset within the project filled with metadata and responsive to interaction, changes in lighting, etc.

- Simulation: generate training data for machine learning algorithms using virtual recreations of real-world environments (like for autonomous vehicles in San Francisco) and running thousands of instances in each batch. Unity Simulation customers include Google’s DeepMind and Unity teamed up with LG to create a simulation module specific to autonomous vehicles.

- Human Machine Interfaces (interactive screens): create interactive displays for in-vehicle infotainment systems and AR heads up displays, as showcased by Unity’s 2018 collaboration with electric car startup Byton.

Unity’s ambitions beyond gaming ultimately touch every facet of life. In his 2015 internal memo in favor of acquiring Unity, Facebook CEO Mark Zuckerberg wrote “VR / AR will be the next major computing platform after mobile.” Unity is currently in a powerful position as the key platform for developing VR / AR content and distributing it across different operating systems and devices. Zuckerberg saw Unity as the natural platform off which to build “key platform services” in the mixed reality ecosystem like an “avatar / content marketplace and app distribution store”.

If Unity maintains its position as the leading platform for building all types of mixed reality applications into the era when mixed reality is our main digital medium, it stands to be one of the most important technology companies in the world. It would be the engine everyone across industries turns to for creating applications, with dramatically larger TAM and monetization potential for the core engine than is currently the case. It could expand up the stack, per Zuckerberg’s argument, into consumer-facing functions that exist across apps, like identify, app distribution, and payments. Its advertising product is already in position to extend into augmented reality ads within apps built with Unity. This could make it the largest ad network in the AR era.

This grand vision is still far away though. First, the company’s expansion beyond gaming is still early in gaining traction and customers generally need a lot of consulting support. You’ll notice other coverage of Unity over the last few years all tends to mention the same case studies of use outside gaming; there just aren’t that many than have been rolled out by large companies. Unity is still in the stage of gaining name recognition and educating these markets about what its engine can do. There are promising proof points of its value but market penetration is small.

Second, the era of AR as “the next major computing platform after mobile” seems easily a decade away, during which time existing and yet-to-be-founded tech giants will also advance their positions in different parts of the AR tech, authoring, and services stack. Apple, Facebook, Google, and Microsoft are collaborators with Unity right now but any of them could decide to compete with their own AR-focused engine (and if any of them acquire Unity, the others will almost certainly do so because of the loss of Unity’s neutral position between them).

]]>

TechCrunch

TechCrunch

The preliminary suspension order follows a landmark ruling by Europe’s top court this summer which both struck down a flagship data transfer arrangement between the EU and the US and cast doubt on the legality of an alternative transfer mechanism (aka SCCs) — certainly in cases where data is flowing to a non-EU entity that falls under US surveillance law.

Facebook’s use of Standard Contractual Clauses to claim a legal basis for EU data transfers therefore looks to be fast running out of borrowed time.

European privacy campaigner Max Schrems, whose surname is colloquially attached to the CJEU ruling (aka Schrems II) — and to an earlier ruling which invalidated the prior EU-US data transfer deal, Safe Harbor, on the same grounds of US surveillance overreach — filed his original complaint about Facebook’s use of SCCs all the way back in 2013. So the tech giant has had more than half a decade to get its European data ducks in order.

Reached for comment on the WSJ report, Facebook pointed us to a freshly published blog post, also penned by Clegg — who acknowledges “significant uncertainty” for businesses operating online services that rely on transatlantic data flows in the wake of the Schrems II ruling.

In the blog post the former deputy prime minister of the United Kingdom goes on to advocate for “global rules that can ensure consistent treatment of data around the world”.

“The Irish Data Protection Commission has commenced an inquiry into Facebook controlled EU-US data transfers, and has suggested that SCCs cannot in practice be used for EU-US data transfers,” Cleggs writes. “While this approach is subject to further process, if followed, it could have a far reaching effect on businesses that rely on SCCs and on the online services many people and businesses rely on.”

Facebook’s blog post lobbying for global rules to ensure “stability” for cross-border data transfers paints a picture of how the Schrems II ruling might negatively affect European startups — claiming it could result in local businesses being unable to use US-based cloud providers or run operations across multiple time zones.

The blog post doesn’t have anything much to say on how Facebook itself having to stop using SCCs might affect Facebook’s own business — but we’ve discussed that before here. (The short version is Facebook may need to split its infrastructure in two, and offer a federated version of its service to EU users — which would clearly be expensive and time consuming for Facebook.)

“Businesses need clear, global rules, underpinned by the strong rule of law, to protect transatlantic data flows over the long term,” Clegg goes on, before lobbying for regulatory leniency in the meanwhile, as Facebook continues to transfer EU data to the US in what he claims is “good faith” — despite the acknowledged legal uncertainty and the complaint in question dating back well over half a decade at this point.

Here he is pleading for data transfer mercy on behalf of other businesses who are not involved in this specific complaint: “While policymakers are working towards a sustainable, long-term solution, we urge regulators to adopt a proportionate and pragmatic approach to minimise disruption to the many thousands of businesses who, like Facebook, have been relying on these mechanisms in good faith to transfer data in a safe and secure way.”

EU lawmakers warned recently that there would be no quick fix for US data transfers, despite some parallel Commission noises about working with the US on an enhanced replacement mechanism for the now defunct ‘Privacy Shield’. (Although for businesses that aren’t, as Facebook is, subject to FISA 702 there may be ways to use SCCs for US transfers that are legal, or at least law firms willing to suggest measures you could take… )

Speaking to the EU Parliament last week, justice commissioner Didier Reynders suggested changes to US surveillance law will be needed to bridge the legal schism between US surveillance law and EU privacy rights.

And of course legislative changes require both time and political will. Although it’s interesting to see Facebook’s global VP feeling moved to wade in and call for global solutions for cross-border data transfers. Perhaps the tech giant will funnel some of its multi-million dollar domestic lobbying budget on making the case for reforming US surveillance law in future.

Ireland’s data protection regulator declined to comment on the WSJ report when we got in touch.

Schrems, meanwhile, is not sitting on his hands. In a statement following the newspaper’s report he said his digital rights not-for-profit, noyb, was not informed about the preliminary order by the DPC — speculating the information was leaked to the newspaper by Facebook to draw political attention to its cause.

He also reveals an intent by noyb to start a legal procedure against the DPC, saying it informed Ireland’s regulator this week that it plans to file an interlocutory injunction over the opening a ‘second’ procedure into the matter — arguing this move is in breach of a 2015 court order and is essentially the equivalent of letting Facebook carry on a multi-year game of legal whack-a-mole where it never actually faces enforcement for breaking each specific law.

“Facebook is knowingly in violation of the law since 2013. So far the DPC has covered them and for seven years refused to enforce the law. It seems after the second judgement by the Court of Justice not even the DPC can deny that Facebook’s international data transfers are built on sand,” Schrems told TechCrunch.

“At the same time, Facebook has in internal communication indicated that it has again shifted its legal basis from the SCCs to [the GDPR] Article 49 and the contract they allegedly sign with users. We are therefore very concerned that the DPC is again only investigating one of two legal basis that Facebook uses. This approach could lead to another frustrated case, like the ‘Safe Harbor’ case in 2015.”

What’s new since 2015 is Europe’s General Data Protection Regulation (GDPR) — which came into application in May 2018 and has led EU lawmakers to claim standard-setting geopolitical glory, as the issue of data privacy has risen up the agenda around the world, propelled by the deforming effects of platform power on societies and democracies.

However the two-year-old framework has so far failed to deliver anything much at all on major cross-border complaints which pertain to platform giants like Facebook (or indeed to the adtech industry). This summer a Commission review of the regulation highlighted what it described as a lack of uniformly vigorous enforcement.

Ireland’s DPC is fully in the spotlight on this front too, as the lead regulator for a large number of US tech firms.

It finally submitted the first draft decision on a cross border complaint earlier this summer — but a final decision on that case (relating to a Twitter security breach) has been delayed as the draft failed to gain the backing of all the region’s data supervisors, triggering further procedures related to joint working under the GDPR’s one-stop-shop mechanism.

Any order from the DPC to Facebook to suspend SCCs would similarly need to gain the backing of the bloc’s other regulators (or at least a majority of them). Per the WSJ’s report, Ireland’s regulator has given Facebook until mid-September to respond to the order — after which a new draft would be sent to the other supervisors for joint approval.

So there’s further delay built into the GDPR process before any final suspension order could be issued against Facebook in this seven year+ case. Move fast and break things this most certainly is not.

The WSJ also speculates that Facebook could try to challenge such an order in court. “Internally, Facebook considers the preliminary order and its future implications a big deal,” it adds, citing one of its unnamed sources.

]]>

TechCrunch

TechCrunch

The top-line message from the secretary of state for digital, Oliver Dowden, is that government wants the “high watermark” of data sharing that’s been seen in the UK during the pandemic to be the new normal for the 2020s — greasing the pipe for “businesses, government and organisations to innovate, experiment and drive a new era of growth”, as he puts it.

“The new strategy will look at how the country can leverage existing UK strengths to boost use of data in business, government and civil society,” the government writes. “It proposes an overhaul in the use of data across the public sector and the government will launch a programme of work to transform the way data is managed, used and shared internally and with wider public sectors organisations, to create an ethical, joined up and interoperable data infrastructure.”

By “data” the policy paper makes it clear that the government means the whole ‘kit & caboodle’ — aka “information about people, things and systems” — though the focus of the strategy is purely on digital data, not information held on paper.

“Given the significant technological changes of the last five years, and the more significant changes we expect to see throughout the 2020s, we need a data strategy that reflects the opportunities and challenges of our new hyper-digital world, and ensures that the decisions, priorities and potential trade-offs that we face are considered in a deliberate and evidence-driven way,” it goes on.

In the early stages of the pandemic, the UK quickly inked a number of health data-sharing deals with tech giants including Google and Palantir — granting access to health information on millions of UK citizens to develop a data platform to coordinate its response to the COVID-19 public health crisis.

At the time it touted the power of “secure, reliable and timely data” to inform “effective” pandemic decisions. Though the arrangements have attracted controversy over their scope and lack of transparency.

Now the government is saying it wants this ‘pandemic level’ of urgency to apply everyday, accelerating data sharing across government and beyond regardless of whether or not there’s a burning health emergency.

To feed its grand ambition of data-fuelled ‘levelling up’ of the public sector, the policy paper sets out a major civil service upskilling plan — with the government saying it wants 500 data analysts across the public sector to be trained in data science by 2021. The Office for National Statistics will play a central role here, with the training being delivered by its Data Science Campus.

The government also plans to offer up to ten “innovation” fellowships per year — with the aim of attracting “world-class tech talent” to work with it to support digital transformation in the public sector. It says the fellowships are modelled on a similar US scheme which attracted the lead developer on Google Maps, former CEO of Symantec and co-founder of the Earth Genome Project to work on US government projects.

“Those fellows will sit within No 10, the Government Digital Service and a number of departments, and use their skills to contribute to the kind of fulfilling challenging projects that only the public sector can offer — ones that have a huge impact on society as a whole,” it writes.

A new government Chief Data Officer will also be appointed to lead a “whole-government” approach to transforming data use — with a focus on driving efficiency in public service delivery. This role is in addition to a new Chief Digital Officer post announced last month.

“To help arm the next generation with high quality data skills, the Government will explore new ways to teach undergraduate students data skills that complement the existing current maths and computing curriculums, as well as developing T-Levels which include qualifications on digital skills,” it adds in a press release.

There’s a strong, Brexit-fuelled, de-regulatory whiff to the strategy — with the paper containing lines like: “Having left the European Union, the UK will champion the benefits that data can deliver”; and: “We will promote domestic best practice and work with international partners to ensure data is not inappropriately constrained by national borders and fragmented regulatory regimes so that it can be used to its full potential.”

Yet the government also writes that it’s committed to seeking “positive adequacy decisions from the EU, under both the General Data Protection Regulation (GDPR) and the Law Enforcement Directive (LED), before the end of the [Brexit] transition period”. Although, of course, it’s hardly going to say it wouldn’t like a nice data deal with the EU.

Without an EU data adequacy decision, a post-Brexit UK will be treated by the bloc as what’s known as a ‘third country’ — piling legal risk and friction on data transfers from the EU, with huge implications for the UK’s digital services sector. Per the government’s press release, “data-enabled” UK service exports were valued an estimated £243BN in 2019, or 75 per cent of total service exports — and a major chunk of that business involves EU citizens’ data. So any future barriers to EU to UK data transfers risk blowing a very sizeable hole in the economic component of the strategy.

The UK’s prospects of securing a data adequacy decision from the Commission will depend on how aligned it is with relevant EU regulations. And EU lawmakers confirmed this month that a recent court ruling by Europe’s top court (aka Schrems II) — which struck down a recent data adequacy agreement between the EU and the US — has implications for a post-Brexit Britain (which has its own swingeing surveillance regime).

So the UK’s high level talk here of adopting ‘data maximizing’ domestic standards and blasting through regulatory constraints appears to deny the existence of international standards, international law and geopolitics. It may also be viewed dimly in Brussels if the comments are interpreted as they sound, i.e. like a sideswipe at current EU data standards.

On international data flows the UK strategy also targets what it dubs “unjustified barriers” to cross border data flows — such as localization requirements to store/process data in a particular country.

“The UK will take a leading role in encouraging the removal of such barriers to unlock the growth potential of global digital trade,” it writes, adding that it will seek provisions with trade partners (including via its current negotiations with the EU) to prevent “the use of unjustified data localisation measures”.

The tension between the UK’s desire to slash barriers to data sharing as a strategy to drive economic growth and the parallel need to operate a “trusted” data regime to maintain public trust — and, indeed, access international data — are evident elsewhere in the policy paper, where the government writes: “We want our data protection laws to remain fit for purpose amid rapid technological change.” [emphasis ours]

“To build a world-leading data economy, we must maintain and bolster a data regime that is not too burdensome for the average company — one that helps innovators and entrepreneurs to use data legitimately to build and expand their businesses, without undue regulatory uncertainty or risk in the UK and globally,” the government goes on.

“Given the rapid innovation of data-intensive technologies, we also need a data regime that is neither unnecessarily complex nor vague. Businesses need certainty to thrive, and the government will work with regulators to prioritise timely, simple and practical guidance, especially for emerging technologies, and create more opportunities to experiment safely.”

On the latter, the strategy talks about testing the “possibilities” of sharing data between the public and private spheres.

Specifically, it’s announced a plan to fire up a cottage industry for AI -powered content moderation tools — seemingly to underpin a wider plan to regulate online harms — via a new £2.6M project which it says will “model how improved systems for classification and sharing of data could support a competitive commercial market in tools able to detect online harms such as cyberbullying, harassment or suicide ideation”.

Here’s more from the press release:

The Online Harms Data Infrastructure project is a new £2.6m pilot project, funded through the HM Treasury Shared Outcomes Fund, to explore how improved systems for data sharing and data interoperability could support innovation and competition in the detection of online harms. This project will analyse the current data landscape and the economic and social benefits of opening up online harms data, and then test a number of potential practical solutions. It forms part of the wider programme of work led by DCMS and Home Office to make the UK the safest place in the world to go online, and the best place to grow and start a digital business.

Through this programme, the government says it will “review and upgrade the data standards and systems that underpin the monitoring and reporting of online harms such as child sexual abuse, hate speech and self harm and suicide ideation”, per the policy paper — which, again, is a reference to its ambitious plan to regulate online content by imposing a duty of care on platforms.

It’s not clear how the government proposes to enable the sharing of such sensitive user data with commercial entities via this program without major data protection risks.

“Beyond the commitment to open data, the government has long recognised that new models and approaches are needed to drive value from data and data systems that span the private and public sector – this is particularly important in cases where the data itself is not appropriate to be shared as open data, be it for privacy, national security or commercial reasons,” is all the policy paper has to say on that.

It’s worth noting that the government has dipped its toe in the water on the public-private AI content moderation front before now. Back in 2018, the then Home Secretary announced a machine learning tool, developed with public money by a UK AI firm, which it claimed could automatically detect propaganda produced by the Islamic State terror group with “an extremely high degree of accuracy” — as it sought to amp up pressure on Internet giants to accelerate takedowns of terrorist content.

As an extended aside, the UK company that developed that tool was called ASI Data Science. The company has since rebranded to Faculty — a name that may be familiar as it’s one of tech firms granted access to UK citizens’ health data as part of the government’s COVID-19 response data platform. (That Faculty contract — providing “strategic support to the NHSX AI Lab” — had a value in excess of £1M.)

The firm has in fact won a swathe of UK government contracts in recent years, since working on the pro-Brexit Vote Leave campaign with senior government advisor (and defacto data guru in chief), Dominic Cummings. So you can at least see one clear thread running right through this national data strategy.

In another component of the plan that could open up startup opportunities, the government says it wants to expand on the current “Smart Data” initiatives — such as the Open Banking scheme — to enable service switching and innovation across more sectors via regulated data sharing.

On this it says it will bring forward primary legislation to give people “the power to use their own data to find better tariffs in areas such as telecoms, energy and pensions, and open the doors to disruptors in every part of the marketplace”.

“The government is committed to an economy where consumers’ data works for them, and innovative businesses thrive. We expect that, in time, the extension of Smart Data will deliver new and innovative services, stronger competition in the affected markets, and better prices and choice for consumers and small businesses, including through reduced bureaucracy. Competitive data-driven markets can reduce friction for business and drive start-ups, investment and job creation,” it adds.

UK business groups have welcomed the government’s plan. In a response statement, Felicity Burch, director of digital and innovation, for the CBI, said: “Data underpins the modern economy and is essential to businesses in every sector from logistics to retail. It’s at the heart of global trade, competition, and innovation in areas from health to climate change. We welcome the National Data Strategy as a vital step for the UK be at the forefront of the data revolution. Lessons learnt in the coronavirus crisis must power our economic recovery – crucially, unleashing the power of data in a way that commands trust and empowers people.”

The government’s PR also includes a very supportive statement from Darren Hardman, general manager for Amazon Web Services (UK and Ireland) — with the tech giant eyeing massive upsides in any wholesale public sector shift to big, interoperable, cloud-hosted data. “Making more effective use of data and cloud computing is key to the UK’s long-term economic growth and the continual improvement of our public services,” he suggests. “We welcome the launch of this consultation on the new National Data Strategy, which will be instrumental in ensuring the UK remains one of the world’s leading digital nations.”

Other responses are more circumspect — with a warning of the risks of “over-collection” and “inappropriate use”, of data coming from Dr Jeni Tennison, VP at the Open Data Institute.

“People and organisations of all kinds are facing big challenges over the next few years. Data can help us all to navigate them, increasing our understanding of our changing world and informing the decisions we make. Data can also cause harm, for example through over-collection and inappropriate use. At the ODI, we want data to work for everyone, which means ensuring it both gets to the people who need it, and that it is collected, used and shared in trustworthy ways,” she said in a statement.

“This National Data Strategy consultation is an important opportunity for us all to explore and influence how data should be used to support the UK’s economy, environment and communities, and we look forward to the debate.”

The consultation on the UK national data strategy can be found here.

The EU recently announced its own strategy aimed at boosting data reuse to drive economic growth — although that focuses on industrial and non-personal data, with rules for personal data sharing continuing to be regulated via the GDPR.

]]>

TechCrunch

TechCrunch

Hello and welcome back to The Station, a newsletter dedicated to all the present and future ways people and packages move from Point A to Point B.

As summer comes to an end, deals have lagged a skosh ahead of what promises to be a busy fall. And while the news cycle continues, there has been a slight dip in intensity. Sounds like a good time to take a break, no? Yup, it is. Next week, there will not be an issue of the newsletter. Don’t worry, it will return Sept. 19.

Email me anytime at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Alright let’s get to it. First up, deals!

Deal of the week

Deals, we got em. And this week, a new SPAC stands out. Yup, you knew it. I knew it; we all knew another SPAC was coming. Some SPAC merger announcements feel like a desperate attempt by young unproven companies to access capital. That’s not the case this week.

QuantumScape, the solid-state battery company backed by Volkswagen Group, agreed to merge with a special purpose acquisition company Kensington Capital Acquisition Corp. The merger will give QuantumScape a post-deal market valuation of $3.3 billion.

QuantumScape is not a fledgling startup. It’s been around for decade, attracting attention and capital early on from high-profile venture firms like Kleiner Perkins and Khosla Ventures. Volkswagen entered the picture in 2012 and has invested a total of $300 million in QuantumScape, including $200 million this year.

QuantumScape is going after the capitally intensive goal of attempting to commercialize solid-state batteries for electric vehicles. Solid-state batteries use a solid electrolyte and not a liquid or gel-based electrolyte found in lithium-ion batteries. Developers claim that solid electrolytes have greater energy density, which translates into squeezing more range out of a smaller and lighter battery. Solid electrolytes also are supposed to be better at thermal management, reducing the risk of fire and the reliance on the kinds of cooling systems found in today’s EVs.

Other deals that got my attention … (seems a little light this week, no?)

Geely Automobile Holdings plans to raise 20 billion yuan ($2.93 billion) from a public share sale on Shanghai’s STAR Market, funds that will be used to invest in new car models and technologies, Reuters reported.

Zomato, the Indian food delivery startup, has raised $62 million from Temasek, resuming a financing round that it originally expected to close in January this year. Singapore’s state investment arm Temasek financed the capital through its unit MacRitchie Investments, a regulatory filing showed.

AV spotlight: Yandex

Coverage of automated vehicle technology companies tends to focus on U.S.-based efforts. Rest assured, there is action elsewhere. Yandex, the publicly traded Russian tech giant that started as a search engine, is one of those companies.

The company has expanded into a number of other, related areas (similar to U.S. counterpart Google) including automated vehicle technology. In January, I rode in their self-driving vehicle (with no human behind the wheel) during a demo on public streets of Las Vegas during CES. I’ve never been a huge fan of demos as it can help companies hide problems with their tech. Yandex’s demo was notable however. The vehicle moved confidently, maybe even aggressively, as it maneuvered around a bus that had stopped in the roadway, it handled left turns as well as a parking garage with ease. (this GIF from Yandex is of a drive in Moscow, fyi)

I mention all of this background because Yandex said this week it is spinning out its self-driving car unit from MLU BV — a ride-hailing and food delivery joint venture it operates in partnership with Uber. The move comes amid reports that Yandex and Uber were eyeing up an IPO for MLU last year. At the time, the JV was estimated to be valued at around $7.7 billion.

As part of the spin-out, Yandex is investing $150 million into the business, a sum that will include $100 million in equity, plus $50 million in the form of a convertible loan. Yandex is buying out some of Uber’s shares in this process and will now have a 73% stake in the spun-out business, with Uber owning 19%. The remaining 8% will be owned by Yandex self-driving group (SDG) management and employees. Yandex said it has invested some $65 million in the business up to now.

Spinning out the unit could help improve the unit economics and cost base of the MLU unit, as TechCrunch editor Ingrid Lunden noted in her report. But Yandex says that it’s being done to double down on a more focused investment in self-driving.

A different kind of EV startup

This isn’t an electric vehicle startup; it’s more like EV adjacent. And it’s an app!

A number of apps have popped over the past several years — in step with Tesla’s rising popularity. Most aim to let drivers track and plan their routes and often have a social component. Tezlab is a good example, and I’ve written about them before.

The one I want to introduce you to is called Nikola. The app launched in 2018 as a hobby project of David Hodge, who founded a mass transit app called Embark, which Apple acquired in 2013. Hodge stayed at Apple for several years and then went to Stripe. But the Nikola app compelled him to go out on his own again.

This week, Hodge launched Nikola 2.0. Here’s the gist: Nikola 2.0 is a subscription-based app that provides health monitoring of the owner’s Tesla (just Teslas for now, but Hodge aims to expand).

The app, which is only in iOS right now, gives the user information on battery level trends, efficiency, energy consumption, top and average speed as well as stats on weekly ghost drain and driving and charging history, which can be exported for tax or expense report purposes. Users can also check their battery level with the Nikola Apple Watch complication and compare their performance to other Tesla drivers with Nikola Fleet Stats.

What I am interested in is this other new feature called the Nikola report. It is like a Carfax report that an EV owner can share with prospective buyers when they go to sell their electric vehicle. The data collection for the Nikola report feature is just now getting started.

Notable reads and other tidbits

Welcome to the roundup section of the newsletter …

Bay Area Rapid Transit, or BART, is selling personal hand straps that can be quickly thrown onto poles in the train car for folks would rather not touch any surfaces.

GM and Ford have fulfilled their separate multi-million-dollar ventilator contracts — together delivering 80,000 of the devices to the U.S. government.

GM and Honda signed a non-binding memorandum of understanding to establish an automotive alliance in North America. The deal brings together two automakers that have a long established history of working together. The companies will share vehicle platforms, which will be sold under their respective and distinct brands, as well as cooperate in purchasing, research and development and connected services.

Ike, the automated trucking startup, had some big news this week. Ryder, DHL and NFI have chosen Ike as their automated driving technology provider. These fleets, and some others the company has not yet announced, have collectively reserved the first 1,000 trucks powered by its technology.

The startup also lifted the hood, so to speak, on their business model. Ike is taking a SaaS approach to automated vehicle technology. The company explained in a blog post this week that it will sell a Software as a Service subscription to fleets. Customers will buy trucks equipped with Ike’s validated automation system from its OEM manufacturing partners. Automated trucks will be owned and operated by fleets and “Powered by Ike,” the post read.

REMINDER! Nancy Sun, the co-founder and chief engineer of Ike, will be on our virtual stage for the TC Sessions: Mobility 2020 event October 6 and 7. If you’ve never heard of Sun, or listened to her, be prepared to be impressed. The event is shaping up to be pretty great and we have a few more speakers left to announce.

Lucid Motors, which is set to reveal the Air on September 9, keeps dropping bits of info on the luxury electric vehicle. This time, Lucid announced that the Air is capable of a 9.9-second quarter mile. That’s faster than a Tesla Model S and faster than most production cars on the market.

Metromile, a pay-per-mile insurance company, said it’s teaming up with Ford Motor to provide owners of Ford vehicles equipped with built-in connectivity with personalized car insurance.

Tesla didn’t make it into the S&P 500 as so many had predicted. Tesla fans took to Twitter on Friday to gripe about the decision that welcomed Etsy, Teradyne and Catalan into the S&P.

Torc Robotics and its parent company Daimler Trucks, announced plans to expand their joint self-driving truck on-road testing to New Mexico this month and establish a test center in the Albuquerque area.

The U.S. government rolled out a new online tool designed to give the public insight into where and who is testing automated vehicle technology throughout the country. The official name of the online tool is the Automated Vehicle Transparency and Engagement for Safe Testing Initiative tracking tool. While the design is simple and straightforward, it’s incomplete since it is based off of information that companies have volunteered. Let’s hope this is the beginning of what will become a comprehensive one-stop shop of all automated vehicle technology in the country.

VanMoof, the e-bike company is opening a store in Seattle — its third in the United States. The expansion illustrates the company’s growth, which has accelerated since March as sales of e-bikes in the U.S. popped 85% compared with the same month a year earlier.

Volkswagen released teaser images of its upcoming all-electric ID.4 compact SUV that shows what might just be a nice balance between tech and old timely toggles and buttons. Could this be the Goldilocks story of the EV world? I will find out later this month. Stay tuned.

]]>

TechCrunch

TechCrunch

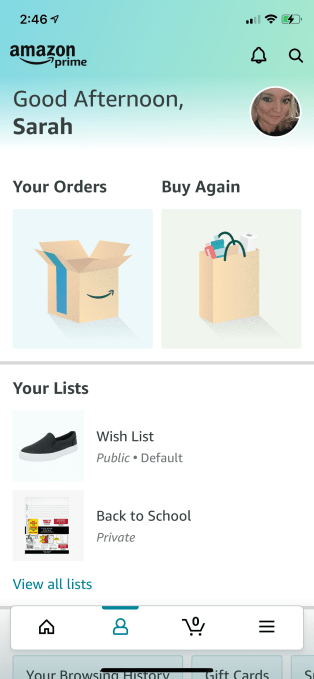

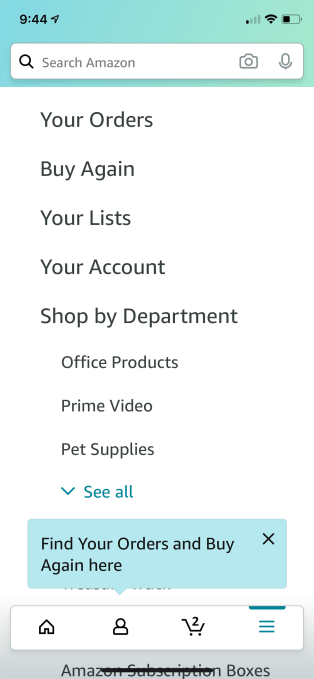

The malls and grocery stores of the 20th century are being converted into industrial conveyor belts of goods and services traveling from the internet to your home. The customer is no longer even allowed inside, as Connie Loizos details this week in a closer look at Amazon and other online-first companies taking over commercial spaces near you.

Americans sort of knew this was coming. Still, the pace at which buildings of all sizes are being either built or converted into e-commerce fulfillment centers — and closer to city centers — has become a bit breathtaking. According to the commercial real estate services firm CBRE, since 2017 at least 59 projects in the U.S. have centered on converting 14 million square feet of retail space into 15.5 million square feet of industrial space, and that trend is “absolutely going to continue,” says Matthew Walaszek, an associate director of industrial and logistics research at CBRE.

Some huge portion of existing retail space is disappearing from public life. Meanwhile, remote work is simultaneously gutting office demand, the even more lucrative part of commercial real estate.

No doubt there will be wonderful new in-real-life experiences that commercial spaces provide for work and any other function. But the sector is taking massive systemic cuts and destroying landlords in one of the historically slowest moving industries in the world. This alone makes it incredibly exciting as a topic for TechCrunch to cover. The impact on startups makes the changes today profound. Will superstar cities and startub hubs retain the pull they’ve had in recent decades? Even if you want to be remote-first, what if you want to get out of the house and your team does too? What if you don’t want to live in a house, actually?

To get more answers at the bleeding edge, Kirsten Korosec and your faithful correspondent did a fresh survey of 9 of the top investors in real estate and proptech (based on our TechCrunch List and other research). Extra Crunch readers can check out what they think will happen to startups soon in the middle of pandemic changes, and where they see proptech going along with the rest of the trends longer term. Here’s one of my favorite excerpts, from Brad Griewe of Fifth Wall:

We don’t believe that abandonment of central business districts will remain an issue following the pandemic. Because the concentration of startup and entrepreneurial activity occurring in cities such as San Francisco and New York is on the decline, we can expect smaller metro areas throughout the U.S. to benefit from a surge in innovation, and the pandemic only stands to accelerate this trend, with many entrepreneurs and knowledge workers having already discovered the benefits of remote work and life outside of high-density areas. While this will not alter our investment strategy, we’re spending time with the office landlords in our network considering alternative spaces for work (e.g., flexible workplace solutions, flex passes, smaller and scattered HQs, cross-purpose retail and dynamic food venues), advances in collaboration technology and the ways in which physical assets can accommodate strong connectivity.

Stay tuned for part two of survey responses coming next week, looking at specific trends that investors are seeing now, like the ongoing growth of coliving.

As markets adjust to Softbank, will we see a slowdown in tech IPOs?

In addition to the numerous other reasons for real and unreal enthusiasm in the stock market, Softbank has been buying up huge shares of tech stocks, and propelling the market further upwards — until this information become clearer in the last few days and the market dropped below what had been surprising peaks. Here’s Alex Wilhelm summing up how the week ended and what’s next:

Tech stocks are taking the worst hits. And inside of tech stocks, SaaS and cloud stocks are enduring even bigger declines. As we’ve noted that some tech shares have taken lumps when their growth has underwhelmed investors, perhaps we’re seeing the entire SaaS sector see their growth expectations slip?

Bulls may say that the above declines are merely a few weeks’ gains and that the accelerated digital transformation is still a key tailwind for SaaS. Bears may say that this is the start of a real correction in the value of tech shares that had become simply too expensive for their fundamentals. What we can say with confidence is that software shares are in a technical correction, and other equities cohorts that we care about are not far behind.

Monday is an off day for stocks. Let’s see what happens Tuesday and if the bleeding stops or simply keeps on letting.

With this update in mind, here’s our ongoing coverage of the busy return (to date) of the IPO market after the pandemic:

The IPO parade continues as Wish files, Bumble targets an eventual debut

What happens when public SaaS companies don’t meet heightened investor expectations?

In amended filing, Palantir admits it won’t have independent board governance for up to a year

An IPO expert bats back at the narrative that traditional IPOs are for ‘morons’

Frugal startups should pay attention to how JFrog’s IPO prices

Everybody is racing to an IPO — even Laird Hamilton’s young ‘superfood’ company

Zoom’s Q2 report details some of the most extraordinary growth I’ve ever seen

The good and the less-good from Sumo Logic’s updated IPO filing

Image: TechCrunch

Snapchat a winner so far from TikTok ban threat

As the September 15 deadline looms for Bytedance, and the likelihood of either a full shutdown or hollow acquisition seem to grow, TikTok users are moving. Even if you’re not working on a consumer startup, the future may be getting rewritten now for your marketing plans on hot social platforms. Nearly every company these days needs to have a public brand presence and a growing number sell direct, after all. So get ready for… Snapchat.

Our resident app expert, Sarah Perez, writes that Snap’s app has a massive 28.5 million new app installs over August, a 29% year-over-year growth rate nearing or beating its past records, and well above July’s (pre-ban announcement) 9%. What about other platforms? It’s harder to track the impact on larger social sites like Facebook and Instagram, as she notes. But my guess is you’ll probably still be buying those Facebook ads well into the future, and probably for more videos too.

The bans probably aren’t done, either. India, which was first to ban TikTok, has added dozens more apps from China, as those two countries continue an armed face-off in real life. Manish Singh, our startup reporter in India, has been following the story closely, and writes for Extra Crunch that so far, TikTok replacements have not been emerging so clearly.

(Photo by Julien Mattia/Anadolu Agency via Getty Images)

Investing in startup hubs around the world

Speaking of the uncertain future of startup hub cities versus the world, the EC team took a different angle to the question this week, by considering the question of how geography-focused investors remain by today? Here’s a blisteringly spicy take from resident former VC Danny Crichton:

It should never have mattered before, of course, but then, sometimes

idiotsHarvard Business grads need a global pandemic to prove that they can actually do their jobs in novel ways. The arbitrage that existed for geographical-focused venture funds is gone, and there is now functionally a nationwide market for VC investments compared to the archipelago of local regions that existed before.There is still room for the absolute earliest capital in these regions, accelerators and pre-PMF funds that will invest in founders with no idea for a startup yet. For all other funds larger than a few million though, the transition is clear: they will likely build upon a successful portfolio company or an area of interest and become vertical-focused. The knowledge arbitrage for an industry vertical is much more defensible than knowledge that the 279 should be avoided at certain times of the day in downtown Pittsburgh or that Tomukun is the best Korean BBQ in Ann Arbor.

Editor-at-large Mike Butcher has also been getting at this question through a series of Extra Crunch surveys with investors across key European startup cities. This week he talked to dozens of investors across Paris and Berlin. The unsurprising theme is that basically everyone is investing across the Continent already, and maybe well beyond. At the same time, many investors in each city expressed a strong belief in the particular city where they are located. Maybe the future unicorns coming out of Europe won’t have massive headquarters in their home cities, but these companies will still be arising from the ether of local people who work in technology — so it won’t end up feeling that different? Here’s how Berlin-based Mathias Ockenfels of Vienna-headquartered Speedinvest explains it:

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

The Network Effects team works from Speedinvest offices in Vienna, London, Berlin and Munich. We’ve made about 75% of our investments within these hubs, and more than half specifically in London and Berlin. While a local focus is very important to us, we do not shy away from making investments in what other investors may consider “fringe” locations, such as Utah in the U.S., Helsinki or Warsaw.Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not)? Which founders?

Berlin continues to be a major hub for fintechs — despite not having a strong finance ecosystem. It also has a strong base of consumer tech companies, such as Zalando, Lieferando/TakeAway and Delivery Hero, but has seen a surge in more B2B-oriented startups in recent years.I believe the startup ecosystem in Berlin will continue to grow and become even more diverse, as it attracts great talent from across the world and becomes a go-to “playground” for entrepreneurs. As the first batch of successful B2B founders are exiting their companies and inspiring other entrepreneurs, I expect more opportunities in the B2B space in the future.

Madrid and Barcelona-based investors, Mike is heading your way next — tell him your views on your cities and your own plans via this link.

Around TechCrunch

Triller CEO Mike Lu to talk taking on TikTok at Disrupt 2020

Fabletics’ Adam Goldenberg and Kevin Hart to talk D2C at Disrupt 2020

Laura Deming, Frederik Groce, Amish Jani, Jessica Verrilli and Vanessa Larco are coming to Disrupt

How to craft the right pitch deck for your company at Disrupt 2020

Submit your pitch deck to Disrupt 2020’s Pitch Deck Teardown

Learn how to raise your first dollars at Disrupt 2020

Some of the brightest minds in Europe are joining us at Disrupt

Welcome to the most important panel on product development in the history of Disrupt

Across the week

TechCrunch

On the matter of who was really behind @VCBrags

Banks aren’t as stupid as enterprise AI and fintech entrepreneurs think

There’s a growing movement where startup founders look to exit to community

The startup world needs a ‘Black Minds Matter’ awakening

Building paths to funding for Black female founders

Dear Sophie: Can we sponsor an H-1B university researcher for an EB-1B green card?

Extra Crunch

Edtech startups find demand from an unlikely customer: Public schools

Your first sales hire should be a missionary, not a mercenary

Jeff Lawson on API startups, picking a market and getting dissed by VCs

What does GPT-3 mean for the future of the legal profession?

Media Roundup: Patreon joins unicorn club, Facebook could ban news in Australia, more

Venture capital LPs are the missing link to solving Silicon Valley’s diversity problem

#EquityPod: Edtech is the new SaaS

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

The whole crew was back, with Natasha Mascarenhas and Danny Crichton and myself chattering, with Chris Gates behind the scenes making it all work. An extra shout-out to Natasha this week as we spent a lot of time talking about edtech, a category that she spearheads for us and has brought to the show. It’s a big deal!

We’re on YouTube now, don’t forget, and with that, let’s get into the news:

- Climax Foods raised $7.5 million to help fuel its work to develop alt-foods that are not animal-based. The Equity crew votes that this is a tasty deal. And, Capchase has raised $4.6 million to help cash-out SaaS contracts ahead of their real revenue accrual. Our read is that more financing options for SaaS companies will lead to lower costs of capital for those startups that want it. And, the Envision Accelerator made it through batch one and is on to batch two.

- Then we chatted about edtech, with Natasha talking us through Owl Ventures raising huge new funds, Course Hero extending its Series B, Juni hitting $10 million ARR and raising about as much and Unacademy raising tons of cash from Vision Fund 2.

- Next up, Patreon also got a new check, which means that it eventually has to go public at some point, given that it is now a fancy unicorn.

- And speaking of IPOs, Bumble is thinking about going public in 2021, Wish has filed, albeit privately, and GoodRX is going public as well. And it makes money.

- What else? This a16z post on IPOs that we fangirl/fanboy’d over, as it is good. And we forgot to mention this Fred Wilson post, but it is also good.

And with that, we are nearly at the weekend, which is a long one thanks to a holiday, so expect Equity Monday to be, in fact, Equity Tuesday next week. Hugs and good vibes from the Equity Crew!

Equity drops every Monday at 7:00 a.m. PT and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

]]>

TechCrunch

TechCrunch

The malls and grocery stores of the 20th century are being converted into industrial conveyor belts of goods and services traveling from the internet to your home. The customer is no longer even allowed inside, as Connie Loizos details this week in a closer look at Amazon and other online-first companies taking over commercial spaces near you.

Americans sort of knew this was coming. Still, the pace at which buildings of all sizes are being either built or converted into e-commerce fulfillment centers — and closer to city centers — has become a bit breathtaking. According to the commercial real estate services firm CBRE, since 2017 at least 59 projects in the U.S. have centered on converting 14 million square feet of retail space into 15.5 million square feet of industrial space, and that trend is “absolutely going to continue,” says Matthew Walaszek, an associate director of industrial and logistics research at CBRE.

Some huge portion of existing retail space is disappearing from public life. Meanwhile, remote work is simultaneously gutting office demand, the even more lucrative part of commercial real estate.